Pain Points:

Download the 'Outgrowing Quickbooks?' Guide

Milestones in business are not unlike milestones in life. Growth and development are facilitated by the right tools. As SME's and their needs grow, they often find that the Quickbooks systems they've used in the past are simply not able to grow with them. As you grow, Quickbooks can begin to pinch and cause pain like a pair of old shoes.

Quickbooks was a good place to start, but it has limited functionality, and will constrain the companies that run it. There are many technologies essential to the growth of a business that Quickbooks cannot address. The right technologies provide increased efficiency, security, and profitability to savvy companies who know when it's time to let go of the past.

Cross-Functional Awareness (CFA) is defined as,

"The positive cross-functional impact of ERP systems ... whereby actors in the different functional areas of the firm are able to collaborate more effectively."

1 CFA allows each member of an organization to visualize each process and understand how they fit into it, like one cog in a well-oiled machine.

A business running Quickbooks may struggle to get programs to work together seamlessly in a real-time fashion, thereby creating information silos. When information is isolated, it can be difficult for the organization to collaborate efficiently.

For example, someone entering an order may lack the CFA to realize how a critical piece of information is used by someone else processing the order. Or an important detail from one software program might not be accounted for because it never got entered into Quickbooks.

This lack of CFA can undermine an organization's purpose. For an organization to run like a well-oiled machine, there must be a true understanding by each member of how each process is interrelated.

A 2014 Study published in the Business Process Management Journal found that ERP integration improves data quality and Cross-Functional Awareness. It found that: "ERP-ISC (a rapid, core function and flexibility oriented ERP implementation strategy based on an organizational vision and BPR) enables greater CFA."1 A quality ERP allows you direct visibility into each interconnected process in real-time, enabling improved collaboration and operation across the organization.

1 Marciniak, Amra-ni, Rowe, & Adam. (2014). Does ERP integration foster Cross-Functional Awareness? Business Process Management Journal. 20 (6), 866, 869.

Improved processes are the bread and butter of increased efficiency and profitability.

Smart organizations are always looking for a way to improve, and it seems they are in good company.

Armanino's 2015 CFO Evolution Benchmark Survey noted that, "90% of Best in Class CFOs standardize and improve processes."

1 And why not? As our world becomes increasingly technological, it seems there are always new innovations to help shrewd businesses stay competitive. Unfortunately, those running Quickbooks as their primary software may struggle to improve their business processes because there is so much functionality that it cannot support.

Implementing an ERP was a key method noted to realize these improvements. "By standardizing and consolidating businesses into a single ERP system, integration of legacy businesses was sped up.

The positive impact on efficiency was felt almost immediately, driven by standardized charts of accounts and common understanding of core financial processes."

The survey noted two top benefits of system integration.

"Time Savings: Instead of requiring time-draining manual import of worksheets, the new automated process takes only 1 O minutes. Real-Time Analysis: With the ability to re-upload data before month-end, team members can see where things stand on an ongoing basis instead of having to wait for one big manual push."

1 CFO Evolution Benchmark Survey. (2015). Location: Armanino

Without integration, information must be input manually into each software platform.

Manual data entry is often incorrect or inconsistent. This just makes unreliability worse.

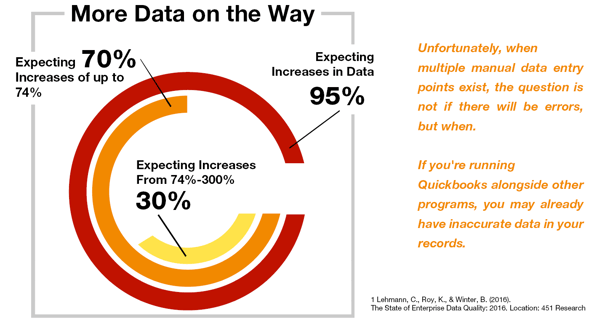

Unfortunately, when multiple manual data entry points exist, the question is not if there will be errors, but when.

Multiple software programs create multiple data entry points. If you're running Quickbooks alongside other programs, you may already have inaccurate data in your records.

Data used for product orders, processing, and sales is the same data used to create reports, evaluate employee performance, and plan for the future of any organization. Ensuring data integrity is crucial for business success, and growth only makes it more complex.

And more data is on the way. The 2016 research report "The State of Enterprise Data Quality," showed that 95% of respondents plan on seeing increases in the volume and the sources of data that their organizations will be sifting through in the next year. Of those, 70% expect increases of up to 74% in data, while nearly 30% expect significant increases of between 75%-300%. 1 How will you handle these types of data increases in your organization?

Perhaps the greatest problem with bad data is when it seeps into financial and compliance records. If errors in data exist, strategic business plans could be based on faulty information. Plans to acquire assets, hire employees, or to accept new projects are jeopardized, not to mention the risk of any potential legal ramifications from inaccurate financials.

Resources that could otherwise be growing the business must attend to digging through numerous files to identify and correct inconsistencies. This all amounts to wasted time and lost revenue.

One focus of a 2014 study published in the Business Process Management Journal was how ERP Integration affects the data integrity of businesses. It found that, "ERP integration is one way of overcoming data quality problems by integrating the disparate data stores of the organization" .1

A single, integrated ERP platform allows accurate, centralized data from each process to flow seamlessly between departments. Financials, CRM, and Inventory are combined. Confusion and errors are reduced and business planning and reports are based on 'one version of the truth'. It just makes sense; with only one data entry point, data is much more reliable. And when data is reliable, businesses can focus on doing business.

Between broadcasters and local government, large cities spend millions of dollars every year getting commuters through congested streets during gridlock.

When SME's grow, they can experience a gridlock of the Quickbooks variety worse than any rush hour.

When large amounts of data are needed for tasks, Quickbooks can bog down, like so many vehicles crowding a highway. This can cause unreliability in all business functions tied to the Quickbooks systems.

Some Questions to Consider:

At moments when insight is most crucial, functions that should flow smoothly, like running reports, can make the system sluggish and take hours, or sometimes even days to complete. At other times, when updates are released, organizations find that links and functions can break.

When this occurs, the CRM, or any other system that draws information from Quickbooks, goes down until repairs can be made. These unpredictable problems can cause headaches and cost money.

1 Marciniak. Amra-ni. Rowe. & Adam. (2014). Does ERP integration foster Cross-Functional Awareness? Business Process Management Journal. 20 (6). 870.

Like a home owner deciding whether to replace an old cast-iron furnace with a new, energy efficient model, the decision to stay on an outdated Quickbooks system is going to cost.

While Quickbooks may suit a small company with fewer employees well as it gets off the ground, the return on investment is diminished as the company grows.

Some questions to consider in order to do a cost/benefit analysis between Quickbooks and a Cloud ERP:

When businesses succeed in adding employees or products and services, their achievement can be overshadowed by the realization that their infrastructure must adapt to growth.

The need to add users, data, and lines of communication to the organization can turn a Quickbooks system that once seemed like a bargain into a liability.

In order to understand a true comparison between Quickbooks and a quality ERP,

organizations must weigh how much valuable time is spent bridging gaps in information for daily operations, collecting and aggregating data for purposes such as audit requests, or correcting mistakes in data.

There was a time when the cost of moving to to an ERP, with expensive servers and maintenance staff, was daunting. Cloud-hosted ERP solutions have made ERP much more affordable and accessible.

Cloud-hosted ERP systems not only improve real-time visibility, but reduce costs by eliminating the need to expand an IT department and hardware entirely. When growing SME's take all of these relevant factors under consideration, it becomes clear; a bargain on financial software that must be limped along is no bargain at all.

As you grow, Quickbooks can begin to pinch and cause pain like a pair of old shoes. The right technologies provide increased efficiency, security, and profitability to savvy companies who know when it's time to let go.