- Solutions

- SAP Business Suite

- SAP Cloud ERP

- SAP Business ByDesign

- SAP Business One

- ERP Integrations & Extensions

- ByDesign vs. Business One

- Industries

- Services

- Resources

- Company

- WATCH DEMO

Search

Today’s Distribution Companies are at the center of a global supply chain; providing the critical link that connects the manufacturer’s goods with customers through many different channels, Wholesale Trade, Business-to-Business (B2B), Business-to-consumer (B2C), and Direct-to-Consumer (DTC). Distribution businesses are balancing the challenges of a dramatic increase in demand, rapidly changing expectations from global partnerships, and increasing competition from opportunistic start-ups looking to capture market share. With that expansion also comes an increased need for advanced software distribution tools.

The scope of Distribution companies has expanded rapidly in the last few years, adding to the challenges of the supply chain, logistics, warehouse, inventory, and the list goes on. Each link in the distribution supply chain is critical to delivering the products and services demanded by the end consumer.

Navigator Business Solutions offers a unique solution for Distribution Companies combining a purpose-built suite-in-a-box cloud platform with years of Distribution Industry experience that has resulted in a portfolio of successful projects.

With continually expanding and complicated supply chains, distribution companies hold the opportunity, good or bad, to impact sales volumes for manufacturers and retailers.

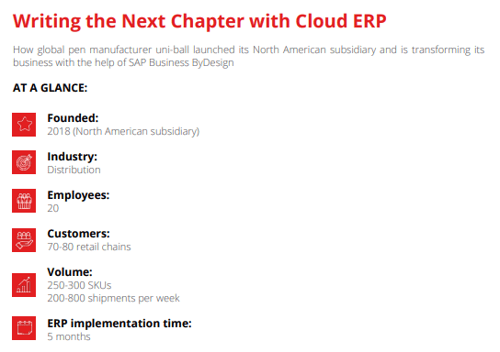

“There were a couple factors that probably pushed us toward SAP Business ByDesign. Number one is that the legacy system for Mitsubishi Pencil is SAP, so there was a feeling that staying with the SAP technology stack would be a good move long-term,”

- Paul Schorr, Lead IT Advisor at Uni-ball

After looking at NetSuite, Oracle and the other major ERP options, uni-ball quickly zeroed in on SAP Business ByDesign, a cloud-based ERP solution for subsidiaries and fast-growing companies.

Explore our client's distribution success stories.

The question of why your company may need ERP is usually brought up by the growing pains your enterprise is experiencing.

You may be currently experiencing distribution trouble with:

Today's dynamic business environment requires distribution industry players to be nimble in order to stay competitive - they must provide the end-customer with the options to purchase products where, when, and how they need them.

To support these more complex inventory demands, companies need to adopt right-sized ERP (Enterprise Resource Planning) solutions to streamline business processes such as logistics, transportation, warehouses, supply chain management, and e-Commerce while providing real-time analytics anytime anywhere. Distribution management software needs to provide all these management solutions along with the option to grow with your enterprise.

Navigator Business Solutions, using a leading SAP cloud-based solution along with its 15 years of expertise built as the leader in the cloud space, has developed industry best practices for distribution companies; all our applications are delivered by seasoned ERP experts. The right Platform, the right solution, and the right partner help guide you and your team through a successful digital transformation management.

How are you addressing:

For a complex industry like distribution and materials management, it is more

If your supply chains cross borders, your ERP software must be able to manage multi-country and multi-currency financials. SAP’s Cloud-based ERP solutions, delivered by Navigator Business Solutions provides unparalleled capabilities to meet your multi-country, multi-currency requirements when managing inventory.

Navigator Business Solutions is in a position to guide your distribution company through the best fit Cloud ERP solution that will address your specific management needs from a single or multi-warehouse distribution network through to a centralized purchasing environment.

Warehouse management systems made for today are simple, capable, and robust at handling inventory. Enable your inventory management team with the software that will make a difference in your bottom line.

Our solution partners are designed for small to mid-size companies running SAP Business One, SAP Business ByDesign, or SAP S/4 HANA Public Cloud and are looking for:

ERP for distribution companies generally presents a toolkit to manage inventory logistics operations first and foremost. Additional activities that distribution ERP tackles include back-end processes such as financial management activities and customer relationship management (CRM). While ERP systems for distribution focus on making inventory, logistics, and warehouse management simple and efficient, those software solutions also need to include all the features of a holistic planning and management solution.

Among the critical advantages that our software solutions offer over less agile products is the ability to customize various modules to suit your organizational needs. Purchasing, accounting, HR, sales, and other operations can all be made to function under one overarching system with ERP software.

Since distribution presents a specific set of challenges, the right ERP solution will be tailored to provide a solution to these inventory challenges.

Inventory management is one of the main challenges you likely face as a distributor and among the most reliant on software solutions, such as ERP systems. Capably implemented distribution software can automate your entire inventory management process to minimize any manual planning, greatly reducing error rates, streamlining processes, and so much more. Inventory management software with scaling capabilities can also grow with your company and eliminate the need for cumbersome software upgrades in the future.

Distribution business software also provides instant visibility across your entire enterprise. Stakeholders can visualize inbound and outbound product flow with ease at the touch of a button when utilizing a software solution.

Additionally, comprehensive ERP solutions offer accurate demand planning which helps cut down on excess inventory and ensures streamlined turnover of your products.

Some of the ERP features you’ll want to consider when choosing distribution software include:

Easy procurement management capabilities. Handling third-party data with ease, scheduling shipments, and establishing recurring purchase orders greatly simplify your operational performance and can be handled by your ERP system.

Customer relationship management that includes individual customer insights, inventory estimates and quotes tracking, and opportunity analytics.

Warehouse management goes without saying but specific ERP features to look for include inventory kitting and tagging, outbound processing, wave and load planning, and demand planning to name a few. Getting the right software features implemented highly depends on the capabilities of your vendor and it’s the biggest determiner of how much value your distribution ERP provides.

Modern ERP systems designed for distributors should automate products sourcing and order processing, which translates to less paper used, fewer errors, and increased efficiency.

There are many different ERP software available on the market. Given the wide variety of ERP options, it can be difficult to choose which one suits your inventory management needs best. The following are some ERP features that you should consider when choosing an ERP software:

Scalability: how easily can the software be scaled up or down? Does the software have a modular architecture?

Scaling up or down is a major issue with many software solutions. A modular software architecture will help make it easier to scale up or down as sales change. This can be done by adding or removing modules to the software without having to change the core of the system.

Support: what kind of support does the company provide for their software? Does the ERP provider offer phone support, email support, videos, tutorials, and more?

Chances are that you’ll be using a system for years once you commit to it, so there’s every reason to expect support from the ERP provider along the way. Look for a company that backs up it’s software with solid and consistent support. You’ll want to feel like you’re working with a management partner, not simply a vendor.

Cost: It seems obvious, but looking at the cost and pricing model of the software should be a top priority. And not just the upfront cost but other investments you might have to make along the way, what pricing options are available, and how willing an ERP vendor is to work around your budget.

Read how Navigator utilizes SAP solutions to help distribution companies like yours scale for years to come.

Read the Top Seven Supply Chain Challenges

ERP provides a single end-to-end system, read the ERP Guide for Distributors.

The wholesale distribution business is changing. Brought about by online marketplaces, the digitization of the buyer journey, wide availability of real-time data, and even a dash of artificial intelligence, wholesale distributors face an inflection point when managing their businesses: Do they adjust to these rapid changes and modernize their distribution operations, or slowly cede ground to distributors and new competitors that do embrace the wholesale distribution landscape today?

This inflection point isn’t just a matter of survival for businesses, of course. It also is an opportunity for capturing a larger share of the market and adding new lines of revenue as the industry is shaken up by changes in technology and buying patterns. The best-run wholesale distributors will benefit from these changes, even if modernization in inventory management is a matter of necessity.

Narrow wholesale distribution is falling by the wayside as the lines between manufacturing, wholesale and retail

blur. Online sales channels are reducing the role of wholesale distributors as manufacturers are selling directly to

retail businesses and often directly to consumers.

At the same time, eCommerce businesses such as Amazon are using their platforms and logistical expertise to expand

from the business-to-consumer model to also include business-to-business offerings.

These shifts are forcing distributors to similarly expand. Specialized distribution is giving way to a broader portfolio

of product and service offerings, such as moving from strict wholesale distribution of plumbing supplies to also

including electrical and HVAC. Narrow product distribution is also being replaced by a basket of offerings that

includes value-added services.

Both the way that customers are buying and their expectations are changing as a result of technology.The typical

business customer is more strapped for time than in the past and has come to expect a buying experience that

resembles consumer purchasing. This has raised expectations around speed, simplicity, availability, reliability and

personalization when it comes to purchasing from wholesale distributors.

The buying journey has increasingly become digital, too, with purchases taking place through mobile and

web-based channels, as well as text messages, voice commands, chatbots, automated ordering through enterprise

resource planning systems, and through a variety of online marketplaces. Wholesale distributors are faced with

expanding their range of channels for sales and support and making the handoff seamless among these channels.

Buyers are also researching purchases online more before the sale, coming in with far greater knowledge, and

requiring that product and service information be readily available online so they can make an informed order. Roughly 64 percent of B2B buyers now

research at least half of their work purchases online, according to Forrester Research.

Along with these changes comes the demand for a more robust customer experience, including seamless

multi-channel communication, greater product information, and more communication among departments.

Traditionally, wholesale distributors have acted as intermediaries between suppliers and customers. The basic business model of warehousing products is no longer sufficient given the blurring of the lines brought about by online purchasing, so distributors now must reinvent their businesses. This requires both new technology and fresh thinking in management approaches.

"Best-run" wholesale distributors leverage technology and empower employees to focus on-value tasks, improved decision-making, and the ability to move opportunistically into adjacent market” notes a recent IDC report, Becoming a Best-Run Midsize Wholesale Distributor

Attracting top talent for inventory management and relationship management is an urgent need for many distributors today. This requires modernizing operations and creating a positive work environment with easy-to-use tools, employee collaboration, and a minimum of mindless tasks.

At the same time, developing innovative business models requires the best of current and future technology. Many wholesale distributors run their operations with aging or patched-together systems that served the industry in the past but now limit innovation and changing business models.

Specifically, legacy IT systems cage data in system silos that reduce informational use and overall operational visibility and hinder real-time operations. Aging IT systems also limit the opportunities for taking advantage of advanced automation and new technologies such as artificial intelligence. An old software system will discourage the top talent needed for innovation from joining firms, too.

How Top Distributors are Handling Modernization

Wholesale distributors are addressing the changing distribution landscape in a variety of ways, but three clear priori- ties emerge for distributors that are considered the best run.

Improving productivity. Roughly 39 percent of the best-run wholesale distributors consider productivity improvements a key business priority, according to IDC research. Among all wholesale distributors, only 28 percent consider it important.

Adding new revenue streams. A second top priority right now for the most successful wholesale distributors is adding additional revenue streams to combat the chipping away of traditional lines of business. IDC research has found that 38 percent of the best-run wholesale distributors are focusing on the development of new revenue streams, compared with only 24 percent overall and 20 percent of the wholesale distributors that are lagging behind.

Transforming the business. The most significant difference between best-run wholesale distributors and the competition is a focus on overall business transformation from management to ground-floor operations. IDC found that 34 percent of wholesale distributors that are considered best-run believe business transformation a top priority, compared with only 23 percent of wholesale distributors overall and 10 percent among the businesses that are lagging behind.

Adapting to the changing market for wholesale distribution and thriving in this new environment requires several deep adjustments within the typical business. The best wholesale distribution companies are undergoing these adjustments and staying competitive with new features, operation models, and innovative software.

While there is no one right approach for meeting the modernization challenge, five key strategic priorities consistently emerge among the best-run wholesale distribution businesses right now.

The wholesale distribution industry, partially owing to its foundation in bridging the gap between manufacturers and customers, has historically focused on operational needs rather than improving management or customer relations. The best-run wholesale distributors are shifting instead to a more strategic focus that aligns operations with the larger management goals of business growth and better-serving customers.

Establishing strategic metrics and monitoring these metrics through data intelligence is a big part of addressing industry change for the most successful wholesale distribution businesses. These wholesale distribution businesses are shifting to analyzing data as a central part of their business management.

While the typical wholesale distributor primarily uses data for increased operational efficiency, according to IDC research, top distribution businesses focus less on data for operational efficiency and use it instead for a wider range of business goals. These uses include:

• Improving customer service

• Gaining customer insights

• Improving access to employee data

• Generating additional revenue streams

• Gaining competitive insights

• Driving product innovation

Of course, the best wholesale distribution businesses also use data for operational efficiency. This focus on data and strategic priorities makes wholesale distributors more agile and able to balance operational realities with insights to drive growth.

Innovation has not traditionally been an emphasis for wholesale distributors, which focus primarily on logistics within their ecosystem. As the industry looks for new sources of growth, however, top wholesale distributors are using management innovation for additional revenue streams and novel business models.

This is a key difference between wholesalers that are modernizing and those that are falling behind. While nearly all of the best-run wholesale distributors say they use innovation well or very well, according to IDC research, only 8 percent of distributors that are struggling say the same thing.

Wholesale distributors are using a range of new software and technologies to foster this innovation, including:

• Mobile devices that can execute all core business functions

• Advanced data analytics and management dashboards for easy access

• Enterprise collaboration tools

• Cloud computing

• Internet-connected devices (Internet of Things)

• Cognitive computing

• Machine learning

• Blockchain

Great distribution businesses also are encouraging innovation in a variety of ways, including actively looking outside their company and industry, having programs that reward innovation, launching internal innovation teams, and designating time during the workweek for employees to explore and play around with innovative ideas that can improve limited capabilities.

With heightened competition, wholesale distributors are under significant pressure to differentiate their businesses and cultivate loyal customers. This is leading the top distributors to double down on customer service and focus on exceeding buyer expectations.

Wholesale distributors are improving relationship management in two primary ways.

First, they are supporting a wider range of customer channels such as chat and text messaging, and unifying these channels on the backend so all customer interactions are centrally stored and accessible within their CRM. This creates a more unified customer experience and more continuity between interactions.

Second, wholesale businesses are breaking down operational silos and using enterprise resource planning software that serves as a single source of truth instead of data being spread across multiple databases with no overarching management. This ERP system enables analytics and a much clearer picture of the customer, which in turn is being used for an improved customer experience.

Meeting the challenges that wholesale distributors face today requires employees that can develop innovation, think creatively, and better support customers. This requires that wholesale distributors attract and retain top

talent, a struggle for many distribution businesses.

Wholesale distributors that are modernizing and meeting the challenges of the industry are therefore stressing an improved employee experience. Some of the methods that top wholesale distributors are using:

• Process automation

• Talent management software

• User-friendly computer systems

• Enhanced employee needs awareness

• Programs for employee development

• Increased collaboration

• Mobile-enabled operations

Roughly 73 percent of the best-run wholesale distributors are currently using talent management software, according to IDC research, and 82 percent of wholesale distributors strive to empower employees with process automation.

A central component of modernizing wholesale distribution among top distributors is breaking down operational silos and improving automation through the use of a centralized enterprise resource planning system (ERP) that serves as a single source of truth.

IDC research has shown that there is a large discrepancy between the IT capabilities of the best-run wholesale distributors and those that are struggling today.

The use of a centralized, cloud-based ERP system is a key component of the strategy for meeting the challenges of the wholesale distribution industry because the wholesale distribution software helps with the collection and analysis of operational data, drives automation, enables innovative business models, and generally serves as the foundation for digital transformation.

Looking for an ERP Solution as a B2B Distribution Company?

Looking for an ERP Solution as a B2C Distribution Company?

Looking for an ERP as a DTC Distribution Company?

At the center of all five of these strategic priorities is digital transformation, the process of modernizing a business by reconfiguring the operations and management strategy of the organization around the latest digital technologies and software.

Almost all—99 percent—of best-run wholesale distributors surveyed by IDC said that the adoption of new, disruptive technologies would provide their business with a competitive advantage, compared with only 69 percent of wholesale distributors overall and 34 percent of lagging wholesale distributors.

The best-run wholesale distributors are focusing on digital management transformation because the latest software and cloud systems streamline operations through visibility, analytics, automation, and areas such as process standardization, all of which improve productivity in distribution. Most of the new opportunities in the market revolve around advancements in technology such as artificial intelligence and the blockchain, too.

Digital transformation also is at the center of overall business transformation because technology is the key driver behind most of the changes and innovations in business today. Businesses that are modernizing are doing it through digital transformation.

For wholesale distributors, digital transformation encompasses five key dimensions.

Using digital technology to move the customer closer to the center of every business decision through more complete, holistic feedback and real-time analytics.

Roughly 70 percent of business leaders surveyed by the SAP Center for Business Excellence and Oxford Economics said that they have seen significant or transformational value in customer satisfaction and engagement from digital transformation, compared with only 22 percent of businesses that had not undergone digital integration to their management and operations.

Improving productivity, teamwork, and overall job satisfaction through a digital work environment that is tightly connected, enables mobility and collaboration and provides real-time information

for a culture of management through data-driven insight.

SAP and Oxford Economics have found that 64 percent of business leaders say that their employees are more engaged thanks to digital transformation, and 94 percent of best-run wholesale distributors are striving to improve connectivity and engagement across their workforce, according to IDC.

Connecting systems at every link in the supply chain for better management efficiency and real-time responsiveness.

The heart of a wholesale distribution business is its network of supplier and customer relationships, and digital integration helps connect this network more completely and efficiently for better inventory management.

Innovating through the use of new technologies and software such as machine learning, internet-connected devices, and blockchain distributed ledger technology.

Half of the digital business leaders are investing in machine learning right now, according to SAP and Oxford Economics, compared with just 7 percent of leaders less focused on digital transformation.

Taking advantage of analytics and cloud technologies for developing product packages and subscription opportunities.

Roughly 98 percent of best-run wholesale distributors are looking to create new business models and revenue streams, according to IDC, compared with only 78 percent of wholesale distributors overall and a little more than half of the distributors that are falling behind.